The Venezuela saga gets more cockamamie by the day. It turns out that the predicates for kidnapping the president of a country that poses no threat whatsoever to America’s Homeland security are about as threadbare (and even comical) as they come. For instance, did the DOJ writers of the superseding indictment of Maduro and his misses not turn bright red with embarrassment when penning this gem:

“Possession of machine guns and destructive devices” and “conspiracy to possess machine guns and destructive devices” in furtherance of the narco-terrorism and cocaine importation conspiracies.

WTF! For better or worse, the man was the president of a sovereign nation-state, and the very essence of such institutions is that they have all the guns or at least most of the big, really lethal ones such as military-style machine guns. So this amounts to an “excuse me for existing” charge, but also something even more to the point.

The definitions in section 924(c) on which this machine gun charge was based derive from the National Firearms Act of 1934 (NFA). The latter was passed during Prohibition’s aftermath to combat armed gangsters like Al Capone, John Dillinger and Baby Face Nelson – all of whom famously used Thompson sub-machine guns (“Tommy guns”) in the conduct of their day jobs.

Of course, Prohibition was a disaster for endless reasons, but among them was surely the fact that the bonneted ladies of the temperance societies ended up causing more people to be killed by the machine guns of the booze-running gangsters than were being felled by excessive fondness for Demon Rum. Likewise, the reincarnation of Prohibition in today’s War on Drugs generates far more maimed and dead collateral victims – especially in the case of cocaine – than the contraband drugs themselves.

That is to say, on its own the annual fatality rate among the nation’s 5 million cocaine users is a tiny0.1% or identical to the 0.1% fatality rate for the nation’s 178 million (now legal) alcohol users. Yet since the utterly misbegotten War on Drugs has forced cocaine dealers into the Al Capone-style criminal black markets and subjected them to massive law enforcement attacks and interdiction losses, it has driven the price of cocaine from $400 per pound in the coca fields to $54,000 per pound for customers on the retail streets in the USA.

In turn, these massively bloated prices make pure cocaine 500X more expensive than fentanyl compounded in backyard chem labs on a per dose (“high”) basis. So, not surprisingly, coke dealers adulterate their high-cost cocaine out of the brick with practically zero cost-baking soda, which imitates its color and texture. They then add tiny pinches of high-potency (and deathly) fentanyl to their retail dime-bags in order to maintain its potency.

Needless to say, this kind of dangerous adulteration driven by government-created black market economics does sharply reduce dealers’ cost of goods sold and enhances their net profits. But it also generates upwards of 20,000 deaths per year in the US owing to fentanyl-adulterated coke. That’s actually more than four times more deaths than caused by pure cocaine overdoses alone.

As we will show in Part 3, however, if cocaine production, transit and distribution were legal, the street price would likely plunge by more than 95%, thereby removing any incentive for (legal) dealers to adulterate their product with pure poison. Indeed, in a legal market there would be no economic incentive at all to adulterate in this manner; and the deterrent of massive wrongful death suits would ensure that CVS, Walgreens etc. sold only safe (pure) product.

Yet the Donald and his band of MAGA fools domiciled on the Potomac cheered when the Navy blew-up the cocaine carrying speedboats and then virtually wet their pants with excitement when he perp-walked into Federal court the now ex-president of a country that is just a 8% bit player in the black market cocaine trade that would not even exist absent modern day Drug Prohibition.

And we do mean, not exist. Back in the day when the FBI and DEA didn’t exist, either, peaceful commerce handled the nation’s cocaine needs. And it did so with nary a machine gun fired or a Federal drug bust that resulted in over-crowding in the nation’s far smaller, more modest jails. And the price wasn’t sky high either.

As shown in the 1885 ad depicted below, mothers needing to treat with their kids’ toothaches could get a whole bottle of the stuff for 15 cents!

That was peaceful commerce and productive capitalism. It also reflected the fact that 140 years ago Washington was still allowing the good people of Albany New York to decide for themselves what medicines, remedies and stimulants to consume in their daily lives.

1885 Ad For Cocaine Drops

So when we referred to the Donald’s cockamamie invasion of Venezuela, that’s exactly what we meant. Washington’s War on Cocaine is already unnecessarily killing 20,000 Americans per year via adulterated cocaine and thousands more in the course of moving contraband product through violent criminal syndicates from Columbia to the USA retail streets. So bringing the US Navy, Air Force and CIA to a War on Drugs which should never, ever have been declared 55 years ago is the very height of folly.

Yet, that isn’t all. We also have the alleged prize of Venezuela’s 303 billion barrels of oil reserve. But that ain’t nearly what its cracked up to be, either.

To hear the Donald and his minions tell about it, you’d think that someone discovered the equivalent of Saudi Arabia’s legendary Ghawar field in the Orinoco Belt of Venezuela. Alas, nothing cold be further from the truth.

The Saudi Ghawar field, the largest ever discovered, was indeed a black gold mine. In terms of sheer reserve volume, the original petroleum liquids in place thanks to Mother Nature was in the range of 170 billion barrels. Approximately 95 billion barrels have already been lifted since production commenced in 1951, but since the Ghawar field is so naturally prolific the ultimate recovery ratio is estimated at about 75%.

That’s because during geologic times oil migrated upward into anticlinal structures, preserving its lighter composition due to minimal biodegradation and favorable trapping mechanisms. Accordingly, the world’s largest conventional oil field in terms of recoverable reserves encompasses just 8,400 square kilometers in eastern Saudi Arabia, and consists of lighter crude oils trapped in deep carbonate reservoirs from Jurassic-era limestone formations.

That is to say, figuratively speaking the Saudi’s have merely needed to stick a straw in the ground in order to pump to the surface at low cost most of the oil deposited by Mother Nature over the course of the geologic ages. Consequently, after 75 years of oil essentially burbling to the surface owing to natural reservoir pressure – aided in recent decades by water injection – there are still 30 billion barrels of recoverable reserves left at today’s technology and prices.

Needless to say, the Orinoco Belt in Venezuela represents the opposite extreme of geology and therefore cost of production. In contrast to Ghawar, the Orinoco Belt spans about about eight times more territory at about 55,000 square kilometers in eastern Venezuela, which areas contains vast accumulations of extra-heavy crude oil trapped in shallow, unconsolidated sandstone reservoirs.

These deposits formed from ancient marine sediments that underwent biodegradation over millions of years under shallow surface waters, resulted in highly viscous, dense oils with low mobility. Representative of Orinoco oils, Zuata crude has an API gravity of around 9 degrees, classifying it as extra-heavy, with a viscosity that makes it behave more like tar than liquid oil at room temperature.

The crucial economic point is this: Zuata’s low gravity stems from the loss of lighter hydrocarbons through bacterial degradation in the reservoir, leaving behind heavier molecules rich in asphaltenes and resins. Hence, the metaphor of Mother Nature’s thievery.

Ghawar’s Arab Light crude, by comparison, boasts an API gravity of 33 degrees, making it medium-light and far more fluid. This higher gravity results from the field’s deeper burial and isolation from surface waters, preventing significant degradation and retaining volatile components that enhance flow properties.

Likewise, the sulfur content further differentiates these deposits. Zuata oils contain about 2.5% sulfur by weight, earning them the “sour” label due to hydrogen sulfide and other sulfur compounds formed during maturation. The Orinoco’s sulfur originates from organic-rich source rocks in a sulfate-rich environment, while Ghawar’s lower content reflects cleaner carbonate sources.

In terms of reservoir size and original oil-in-place (OOIP), both fields are supergiants, but as indicated their estimated ultimate recoverability rate is vastly different. While the Orinoco’s OOIP is estimated at over 1.3 trillion barrels, which gives rise to the image of massive reserves, only about 20-30% ( @ 300 billion barrels) is deemed recoverable with current technology due to the oil’s natural, stubborn immobility.

In short, Ghawar’s high recovery rate and low extraction cost is due to its excellent permeability and natural drive mechanisms. These differences underscore Orinoco’s “stranded” resource status versus Ghawar’s prolific output. Accordingly, production processes for these fields diverge markedly due to their physical properties.

Ghawar benefits from natural reservoir pressure, allowing primary recovery through simple vertical wells where oil flows freely to the surface at low cost (under $5 per barrel in many cases). Production commenced in 1951, peaking at over 5 million barrels per day (mbpd) in the 1980s, sustained by water injection since the 1960s to maintain pressure. Current output is around 3.5-3.8 mbpd, managed for longevity.

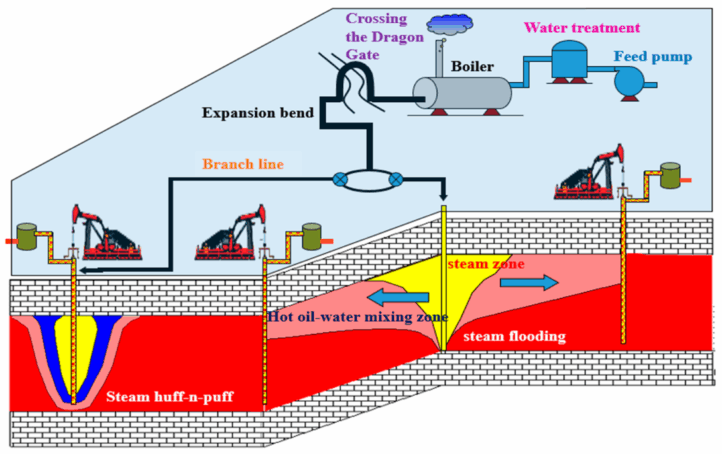

Zuata production, starting in earnest in the 1990s, required high-cost advanced enhanced oil recovery (EOR) techniques from the outset. Steam-assisted gravity drainage (SAGD) or cyclic steam stimulation injects hot steam to heat the viscous oil, reducing viscosity for flow through horizontal wells. This energy-intensive process demands massive water and fuel inputs, with wells costing $10-20 million each versus Ghawar’s $1-5 million.

Due to this far more energy and capital intensive production process, the Orinoco fields demand a high level of equipment maintenance and replacement. The socialist govenrment’s failure to make these investments has caused total output to plummet to under 1 mbpd, far below its 3 mbpd potential.

Post-extraction processing highlights further contrasts. Ghawar’s light crude needs minimal treatment – basic separation of water and gas – at the wellhead before pipe-lining to refineries. Its natural pressure aids transport over long distances without dilution.

Zuata, however, must be heavily diluted with naphtha or lighter crudes (up to 30% by volume) to achieve pipeline-capable viscosity. That adds $10-15 per barrel in costs and requires dedicated upgraders to partially refine it into synthetic crude for export.

Finally, refining Ghawar’s medium-light sour crude is straightforward in standard facilities, yielding high proportions of valuable products like gasoline and diesel after desulfurization. Refining costs average $7-10 per barrel, with simple hydrocracking sufficient.

Zuata’s extra-heavy sour nature demands complex refineries with cokers and hydrotreaters to break down heavy residues, costing $12-15 per barrel or more. But that isn’t all. Crucially, the refined product yield from the Zuata heavy crude is far inferior to that of Saudi light crude for the simple reason that every first year petroleum geology student knows, but apparently no one on the Trump administration ever bothered to check out.

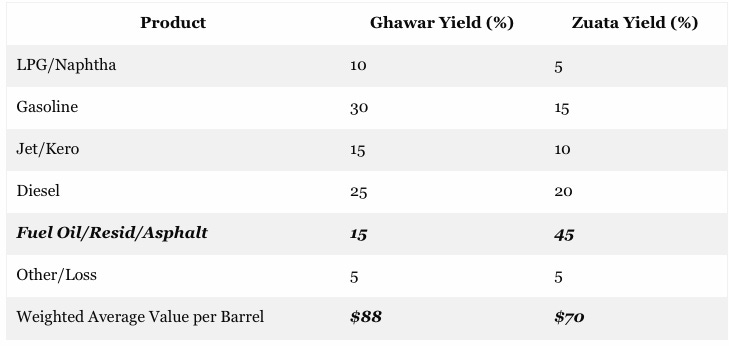

To wit, fully 45% of the refinery yield from Zuata heavy oil consists of low-value fuel oil, residual oils and asphalt, while the high-value light fraction yield (LPG/Naphtha, Gasoline, Jet/Kero) is just 30%. By contrast, the light fraction yield from the Ghawar crude is upwards of 55%, as shown in the table below.

In all, one barrel of crude at today’s wholesale market prices yields $88 of petroleum products from the Ghawar crude oil, but just $70 from the Orinoco Belt heavy crude represented by the Zuata grade.

Product Yield Comparison: Ghawar (Arab Light) vs. Zuata Extra-Heavy Crude

Notes: Yields are rough estimates for typical refinery runs (simple for Ghawar, complex/upgraded for Zuata). Weighted values based on approximate January 2026 wholesale prices: LPG/Naphtha $70/bbl, Gasoline $90/bbl, Jet $85/bbl, Diesel $100/bbl, Fuel Oil/Resid/Asphalt $60/bbl (blended average; asphalt lower at ~$50/bbl). Calculations: Sum (yield % * price). Ghawar’s lighter slate yields higher-value products; Zuata’s heavies pull down the average.

Thus, at the long-term prevailing crude oil marker price of $70 per barrel for WTI, Mr. Market adds substantial cost premiums to convert Zuata heavy into saleable petroleum products. This includes the extra capital, steam, process chemicals, lifting equipment and diluents for pipeline transportation – and then another set of heavy duty cost penalties for extracting high value light petroleum products from the heavy hydrocarbon molecular chains contained in the Zuata heavy oil and various other grade extracted from the Orinoco Belt.

Even then, there is one negative aspect of the Venezuela heavy crudes that even the most advanced extraction and refining technologies imaginable down the road couldn’t overcome: To wit, Mother Nature pulled off a great robbery tens of millions of years ago, when the Orinoco Belt hydrocarbons were exposed to surface waters and other elements. The result was that a high percentage of the light fractions broke-down and evaporated into the mist, as it were. That’s why you get 45% low value bottoms when you refine a barrel of Zuata versus just 15% from Saudi Light.

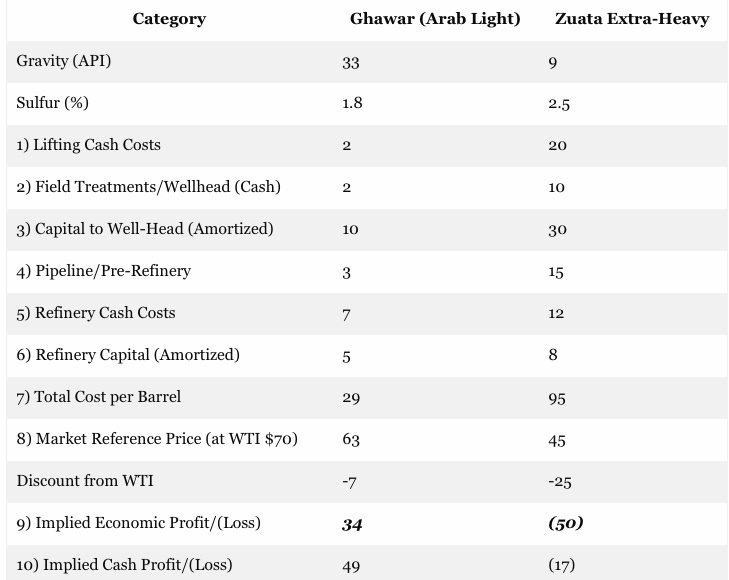

So as shown below, the total vertically-integrated cost per barrel to get crude oil from its reseviors to the refinery gates is just $29 per barrel for Saudi Light versus $95 per barrel for Venezuelan Zuata grade. And then on top of that you have a extra $18 per barrel of discount from WTI owing to Mother Nature’s eons ago theft of the light fractions from the Orinoco Belt.

Needless to say, if it costs a whole lot more to produce and yields a goodly amount less revenue from refined products in the market place, the two commodities at issue here are similar only in that they are called “crude oil”. In the real world, they are actually miles apart when it comes to economics.

That is, the mighty Ghawar field is today generating vertically integrated economic profits of +$34 per barrel, while the Zuata heavy crude generates a -$50 per barrel loss; and even when you set aside capital cost recovery or amortization, which you can’t if you don’t wish to go bankrupt over the longer-term, the $49 per barrel cash profit from Ghawar turns into a $17 per barrel loss in the Orinoco.

Cost Comparison: Ghawar Light Crude (Arab Light) vs. Zuata Extra-Heavy Crude ($/bbl)

Footnotes:

- Gravity and Sulphur values use midpoint of standard range where applicable.

- 1: Lower for conventional fields like Ghawar; higher for heavy/unconventional like Zuata steam injection.

- 2: Minimal for light crudes; increases with viscosity/sourness (e.g., diluents for Zuata).

- 3: Low for mature fields (Ghawar); higher for heavy extraction (Zuata ~$40k-60k per flowing bbl).

- 4: Cheap pipelines for Ghawar; higher for remote/heavy (e.g., diluent costs $10-15/bbl for Zuata).

- 5: Light sweet minimal; sour/heavy adds $2-10/bbl for desulfurization/coking.

- 6: Simple refineries for sweets; complex units add $2-5/bbl amortized for heavies.

- 7: Full-cycle total cost (including amortized capex).

- 8: Typical realized price when WTI is $70/bbl (e.g., Arab Light small discount; heavies discounted $20-30/bbl). Notional averages; actuals fluctuate with markets/sanctions.

- Discount from WTI: Negative value indicates how much below $70/bbl each crude typically trades.

- 9: Economic profit/loss = Market Price – Total Cost (covers cash costs + amortized capex).

- 10: Cash profit/loss = Market Price – Cash Costs only (lines 1,2,4,5; excludes amortized capex in lines 3 & 6). All figures notional; vary with tech/markets.

So there will be no bonanza – even if the Trumpian cowboys succeed in stealing oil from the sovereign state of Venezuela. But even more pointedly, the argument that we need to start a war so that China doesn’t get the privilege of loosing its shirt in the Orinoco petroleum swamp is downright ludicrous.

Yet, the US ambassador to the United Nations on Monday said that enemies of his country cannot be allowed to control vast oil reserves, such as the ones in Venezuela under President Nicolas Maduro:

We’re not going to allow the Western Hemisphere to be used as a base of operation for our nation’s adversaries,” Waltz said. “You cannot continue to have the largest energy reserves in the world under the control of adversaries of the United States, under the control of illegitimate leaders, and not benefiting the people of Venezuela.

The truth is, this is the stupidest reason yet offered by the neocons for starting another Forever War. And yet the MAGA Hats stand with mouth wide open like the idiotic Walz waving the flag and praising the wanna be Macho Man who betrayed them.

David Stockman was a two-term Congressman from Michigan. He was also the Director of the Office of Management and Budget under President Ronald Reagan. After leaving the White House, Stockman had a 20-year career on Wall Street. He’s the author of three books, The Triumph of Politics: Why the Reagan Revolution Failed, The Great Deformation: The Corruption of Capitalism in America, TRUMPED! A Nation on the Brink of Ruin… And How to Bring It Back, and the recently released Great Money Bubble: Protect Yourself From The Coming Inflation Storm. He also is founder of David Stockman’s Contra Corner and David Stockman’s Bubble Finance Trader.