Seventy members of the U.S. Congress (16% of the total membership) are visiting Israel during recess. Most of the private funding for the junket arrives through an entity called the American Israel Education Foundation. AIEF officially formed as a "supporting organization of the American Israel Public Affairs Committee" (AIPAC) in 1988 and applied for tax exempt status in 1989.

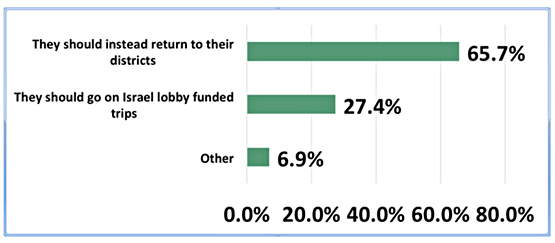

AIEF formed to receive fully tax-deductible contributions for "educational purposes" that could then be funneled into AIPAC initiatives. AIPAC – then as now – is categorized by the IRS as a lobbying organization that can only receive non-deductible contributions. AIEF claimed in filings to the IRS that it would educate students and young professionals about the Middle East and pursue other educational endeavors with a bona fide social welfare purpose. There is nothing in its application for tax exempt status about junkets for politicians. Yet today AIEF funds AIPAC organized trips to Israel for members of Congress costing $10,000 or more per individual. AIPAC staffers organize and conduct the tours. Thanks to AIEF and a handful of similar groups, one out of every three privately funded congressional trips lands in Israel. A recent representative poll of 2,000 voting age Americans asked about the Democratic Party delegation to Israel reveals 65.7% opposed it and think representatives should instead return to their districts.

Poll: 41 House Democrats are now visiting Israel during the Congressional recess on a trip funded by a tax-exempt pro-Israel charity linked to the US Israel lobby group AIPAC.

Source: IRmep representative poll of 2,000 American adults through Google Surveys on August 8-10.

Following the Jack Abramoff travel scandal, a 2007 law was intended to prevent registered lobbies like AIPAC from conducting such junkets. But like laws forbidding foreign aid to clandestine nuclear powers, regulating foreign agents, and combating espionage against the US, the lobbying law is completely ignored as applied to Israel and AIPAC.

One core question is how AIEF ever gained or maintains tax exempt IRS status given the divergence between its original claimed social welfare purpose and observable activities. One reason is the longstanding, mostly unreported, close relationship between the Israel lobby and the US Department of Treasury.

AIPAC and another related entity, the Washington Institute for Near East Policy (WINEP) were instrumental in creating the Office of Terrorism and Financial Intelligence. OTFI has been led exclusively by hard-core Zionists and functions as Israel’s office of boycott, divestment and sanctions.

The IRS has also long been a captive of Israel lobby activity. Under former IRS Commissioner Douglas Shulman the IRS gutted its own oversight of "Friends of Israel" charities shuffling billions of dollars offshore into illegal settlements. Over decades and despite lawsuits and persistent Freedom of Information Act Requests, the IRS still refuses to clarify its position on illegal settlements.

A close tie to the IRS is also the story of how the American Israel Education Foundation came into being. Although AEIF claims it "was created in 1990" it actually formed in September of 1988 and applied for tax-exempt status in April of 1989. AIEF’s application presented tightly argued reasons for why it should immediately – and forever after – be affirmed by the IRS as a tax-exempt educational charity. The IRS delivered a determination letter to AEIF in just four months. There was little chance for a conditional five year "probationary" period which is common for new entities with no track record. That is because of AIEF’s October 11, 1988 (PDF) seven-page justification for why it should receive tax exempt status. It was signed off and most likely entirely drafted by Milton Cerny who had worked as the technical advisor in charge of tax exempt rulings at the IRS National Office in Washington up until departing the IRS in September of 1988 to "begin" work on AIEF’s submission.

Despite well-documented complaint filings to the IRS that AIEF is a prohibited "sham…alter ego" organization of AIPAC, there is little chance the IRS will compare AIEF’s present day activities with its original tax exempt purpose. Likewise for yet another official IRS complaint about AIPAC’s own failure to mention in its 1967 application for tax exempt status that it was formerly an unincorporated lobbying division of an umbrella organization ordered to register as the foreign agent of Israel by the Department of Justice in 1962. In the 1960s IRS Commissioner Mortimer Caplin, a longtime Israel booster, delayed and finally brushed off a 1963 Senate Foreign Relations Committee demand for the review of Israel lobby entity tax exempt status.

Today in an America where key federal and even state agencies are under increasingly intense levels of capture by Israel and its US lobby, warranted accountability and compliance with regulations rigorously enforced on most other taxpayers simply does not exist.

Grant F. Smith is the director of the Institute for Research: Middle Eastern Policy in Washington and the author of the 2016 book, Big Israel: How Israel’s Lobby moves America now available as an audiobook. IRmep is co-sponsor of the annual The Israel Lobby & American Policy Conference at the National Press Club.