The recently passed financial bailout package has drawn the ire of citizens throughout the United States. Both conservatives and liberals have condemned Congress and the White House for rescuing Wall Street titans, who caused the economic death spiral in the first place, by transferring an enormous fiscal burden to middle- and working-class taxpayers. At a time when people are losing their homes and struggling to make ends meet, many Americans find the bailout’s $700 billion price tag to be simply outrageous.

What many Americans may not realize is that the United States is likely to spend $711 billion on national defense in the fiscal year that began on October 1 (assuming fiscal year 2009 war costs are $170 billion, an estimate provided by Secretary of Defense Robert Gates). You read that correctly: the United States will spend more on defense over the next 365 days than on the $700 bailout package.

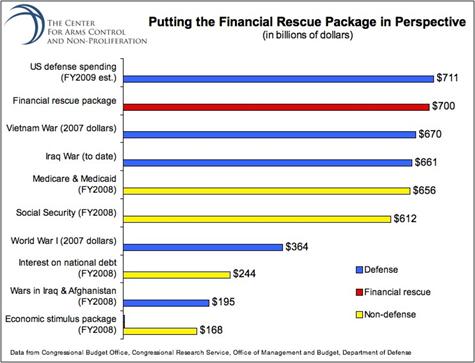

The graph below compares estimated US defense spending in fiscal year (FY) 2009 to the bailout, previous US conflicts, and other federal spending priorities.

Experts have claimed for the past few years that US defense spending, now at its highest inflation-adjusted level since World War II, will start to decline soon. This anticipated downturn has yet to materialize. Presented with war funding requests still labeled "emergency" – even after seven years of war – and motivated by a desire to be seen as pro-defense, lawmakers have been ready and willing to give the Department of Defense (DOD) everything it asks for and more.

With the United States suffering through economic conditions not seen since the Great Depression, however, the era of $700 billion annual defense budgets may soon be coming to an end. "Any crisis of this nature is going to affect – must affect – other federal spending," former chief Pentagon budget official Tina Jonas said about the struggling economy in September. "You cannot look at defense by itself. It is a subset of our macro financial picture." Secretary Gates added that "I certainly would expect [defense budget] growth to level off, and my guess would be we’ll be fortunate in the years immediately ahead…if we were able to stay flat with inflation."

Now, this is not the first time the Bush administration has claimed that defense spending is going down. Lowballing future costs is the oldest trick in the Pentagon’s book. But when high-level officials in an administration as defense-happy (and deficit-careless) as George W. Bush’s speak so openly about potential defense budget cuts, it suggests that spending contractions may indeed loom, particularly with military operations in Iraq ostensibly planned to start winding down in the next 6-12 months.

A troubled economy is not the only threat to $700 billion per year defense budgets. Declining tax revenues and growing mandatory spending are also clouding the fiscal skies. The Bush administration’s tax cuts helped increase the gross national debt over 70 percent (approximately $4 trillion) since FY2001, forcing the government to spend more on debt-interest payments despite generating less tax revenue. Federal spending on both mandatory programs (like Social Security) and debt interest payments, if current trends hold, will consume two-thirds of government revenues by 2015, crowding out other spending priorities like education and housing assistance.

With a new administration and Congress set to assume power in January 2009, today’s economic storm provides an opportunity to make the hard choices that have been put off for too many years. The key question for policymakers today is whether current levels of defense spending reflect the appropriate federal budgetary priorities. Money spent on defense is money not spent on deficit reduction, infrastructure, or developing alternative sources of energy. If certain parts of the defense budget were pruned, such as funding for unnecessary Cold War weapons systems, the savings could be redirected toward other critical needs.

Opportunity cost and budgetary tradeoffs are real. A lot could be done with the $700 billion appropriated for the financial bailout. Even more could be accomplished by trimming the $711 billion flowing into the Pentagon over the next 365 days.

Reprinted with permission from Foreign Policy In Focus.